The Ultimate Guide To Hsmb Advisory Llc

The Ultimate Guide To Hsmb Advisory Llc

Blog Article

Everything about Hsmb Advisory Llc

Table of ContentsThe Ultimate Guide To Hsmb Advisory Llc8 Easy Facts About Hsmb Advisory Llc Explained7 Simple Techniques For Hsmb Advisory LlcNot known Factual Statements About Hsmb Advisory Llc 9 Easy Facts About Hsmb Advisory Llc ExplainedThe Hsmb Advisory Llc Statements

Ford says to stay away from "money worth or irreversible" life insurance policy, which is even more of an investment than an insurance coverage. "Those are very made complex, featured high payments, and 9 out of 10 people do not need them. They're oversold since insurance policy representatives make the largest commissions on these," he states.

Disability insurance coverage can be pricey. And for those who choose for long-lasting treatment insurance coverage, this policy might make impairment insurance policy unneeded.

Hsmb Advisory Llc Things To Know Before You Buy

If you have a persistent wellness issue, this kind of insurance coverage might wind up being crucial (Health Insurance St Petersburg, FL). Do not let it emphasize you or your bank account early in lifeit's generally best to take out a plan in your 50s or 60s with the expectancy that you will not be using it up until your 70s or later on.

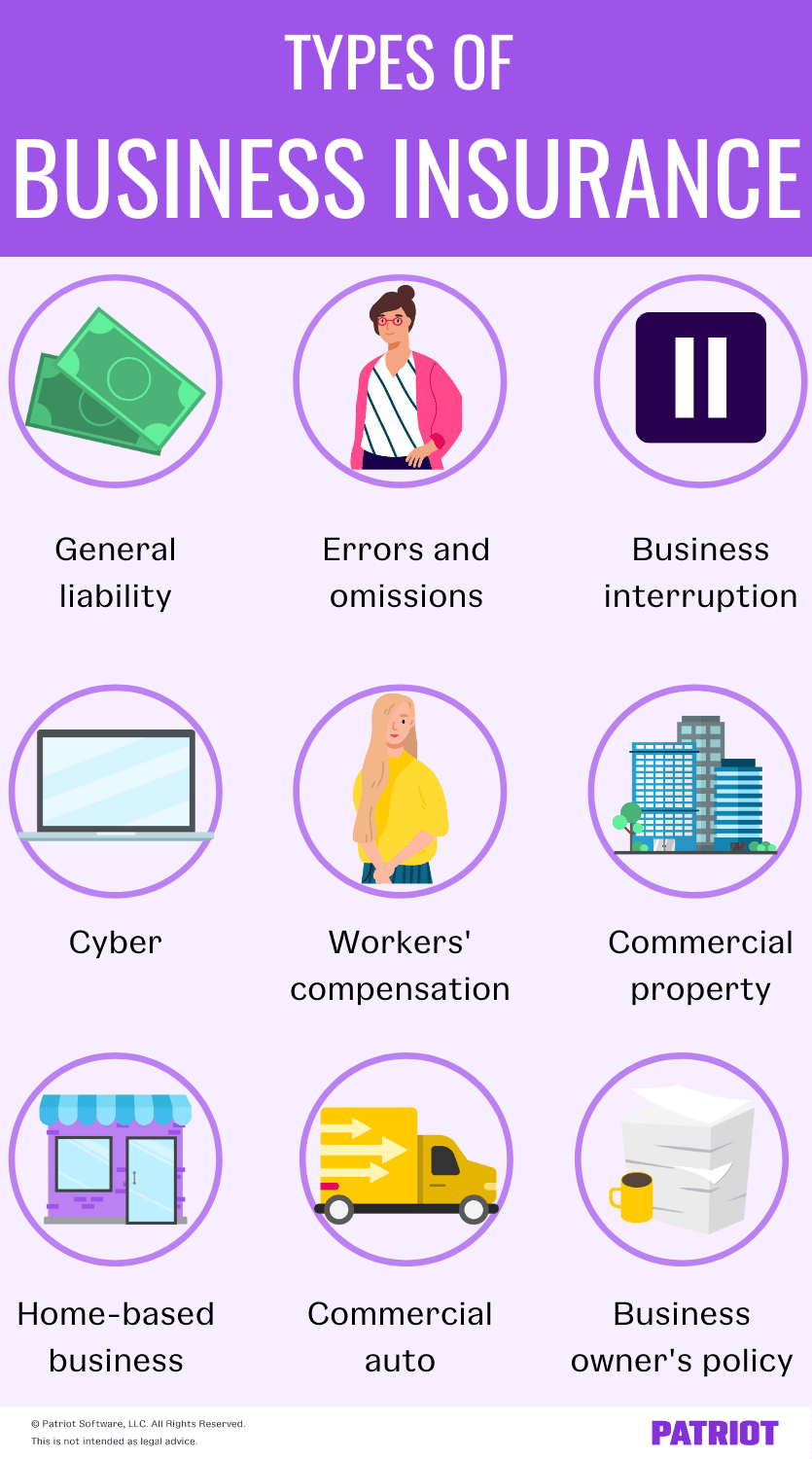

If you're a small-business proprietor, think about shielding your resources by purchasing company insurance policy. In case of a disaster-related closure or period of restoring, business insurance policy can cover your income loss. Take into consideration if a substantial weather event affected your storefront or manufacturing facilityhow would that affect your earnings? And for the length of time? According to a record by FEMA, between 4060% of small companies never ever reopen their doors complying with a catastrophe.

Plus, utilizing insurance might sometimes set you back more than it saves in the lengthy run. If you obtain a chip in your windshield, you may consider covering the fixing expenditure with your emergency situation savings rather of your automobile insurance coverage. Health Insurance.

Some Known Details About Hsmb Advisory Llc

Share these pointers to secure liked ones from being both underinsured and overinsuredand seek advice from a relied on expert when required. (https://gravatar.com/hunterblack33701)

Insurance policy that is bought by a specific for single-person protection or coverage of a family members. The private pays the premium, instead of employer-based wellness insurance policy where the company commonly pays a share of the premium. Individuals may purchase and acquisition insurance policy from any kind of strategies readily available in the individual's geographic area.

Individuals and family members may certify for economic support to lower the cost of insurance policy premiums and out-of-pocket prices, however only when signing up through Connect for Health Colorado. If you experience certain changes in your life,, you Insurance Advise are qualified for a 60-day time period where you can enroll in a specific plan, even if it is beyond the yearly open enrollment period of Nov.

Not known Details About Hsmb Advisory Llc

- Connect for Health Colorado has a full checklist of these Qualifying Life Events. Dependent youngsters who are under age 26 are qualified to be included as member of the family under a parent's insurance coverage.

It might appear basic yet recognizing insurance policy kinds can likewise be confusing. Much of this complication comes from the insurance coverage sector's ongoing goal to develop personalized insurance coverage for insurance holders. In designing flexible plans, there are a range to choose fromand all of those insurance policy kinds can make it hard to understand what a specific plan is and does.3 Easy Facts About Hsmb Advisory Llc Described

If you pass away during this period, the individual or individuals you've named as beneficiaries might obtain the cash money payment of the plan.

Numerous term life insurance policies let you convert them to an entire life insurance plan, so you do not shed insurance coverage. Normally, term life insurance policy premium repayments (what you pay each month or year into your plan) are not locked in at the time of purchase, so every five or 10 years you own the policy, your premiums could climb.

They likewise tend to be less costly total than whole life, unless you acquire an entire life insurance coverage policy when you're young. There are likewise a couple of variations on term life insurance policy. One, called group term life insurance policy, prevails among insurance policy options you might have access to with your employer.The Basic Principles Of Hsmb Advisory Llc

This is typically done at no charge to the employee, with the capacity to purchase added insurance coverage that's obtained of the worker's income. One more variant that you could have access to via your company is extra life insurance policy (St Petersburg, FL Health Insurance). Supplemental life insurance coverage could consist of accidental death and dismemberment (AD&D) insurance, or funeral insuranceadditional coverage that could aid your family in situation something unforeseen happens to you.

Permanent life insurance policy simply refers to any life insurance policy plan that doesn't run out. There are numerous kinds of irreversible life insurancethe most common types being entire life insurance policy and universal life insurance policy. Whole life insurance coverage is precisely what it sounds like: life insurance policy for your whole life that pays to your recipients when you die.

Report this page